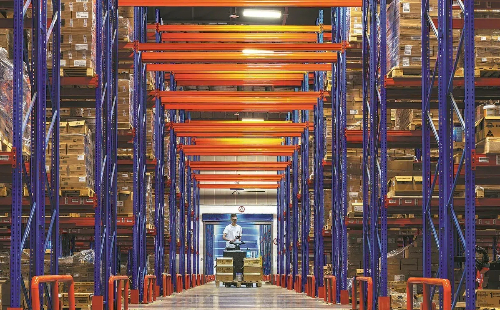

An employee picks imported goods for sale during the Singles Day shopping festival at a cross-border e-commerce bonded warehouse in Jinhua, Zhejiang province, on Oct 23. YANG MEIQING/FOR CHINA DAILY

Chinese consumers have exhibited robust purchasing power for high-quality and intelligent products containing innovative technologies during the Singles Day shopping extravaganza.

Experts said this has played a vital role in promoting the recovery of consumption and shoring up economic growth in the country.

Major Chinese e-commerce platforms have extended the promotional period, and adopted a simple and more pragmatic approach by canceling presale campaigns this year.

Instead, direct price cuts have become the preferred strategy to attract price-conscious customers and bolster sales during China's biggest online shopping event.

Experts also said that unlike in the past, when record-smashing gross merchandise volume, or GMV, through discount-led sales had come to characterize the 11-11 or Double Eleven promotional campaign, chasing high GMV is no longer the focus now.

Chinese shoppers are becoming more rational and carefully reviewing their needs, with an emphasis on the quality and value of commodities, they added.

Data from Tmall, Chinese tech heavyweight Alibaba Group's business-to-customer platform, showed that in the first four hours after the shopping carnival officially kicked off at 8 pm on Oct 21, 174 brands saw their sales surpass 100 million yuan ($14 million).

During this period, the turnover of more than 12,000 brands surged over 100 percent year-on-year and the sales of nearly 6,000 brands skyrocketed more than 500 percent compared with the same period last year.

The transaction volume of Apple Inc's products on Tmall exceeded 1 billion yuan within five minutes, while sales of domestic smartphone brands such as Huawei, Xiaomi and Vivo all surpassed 100 million yuan in the first four hours of the promotional event, according to Tmall.

Consumers preferred to snap up bargains via livestreaming on e-commerce platforms, with sales from some top-tier livestreamers on Taobao Live, Alibaba's livestreaming arm, surpassing 100 million yuan within a short period.

JD, another major Chinese e-commerce player, has launched a subsidy campaign worth 10 billion yuan, and given discounts for commodities included in the consumer goods trade-in program, such as home appliances and computers. It has also stepped up efforts to upgrade supply chains and logistics services.

JD said it recorded a double-digit year-on-year growth in transaction volume, orders, and user numbers between 8 pm on Oct 14, when its promotional gala opened, and 9 pm on Oct 31.

More than 16,000 brands saw their sales surge over threefold year-on-year, while the number of brands exceeding 100 million yuan in turnover increased over 400 percent compared with the same period last year. More than 17,000 merchants witnessed their order volumes soar over five times from a year earlier.

New users who bought apparel and cosmetics via JD's online marketplaces skyrocketed over 140 percent year-on-year, while JD's livestreaming channel saw a 245 percent year-on-year increase in order volumes.

Consumer electronic devices witnessed robust growth during the shopping extravaganza.

The transaction volume of gaming laptops rose 120 percent year-on-year during the shopping spree, and AI smartphones and 4K projectors experienced 100 percent growth in turnover, while the sales of AI learning devices and 3D printers surged over 10 times from the same period last year, JD said.

Furthermore, a series of products that represent scientific and technological innovations achieved by Chinese enterprises have been made available on e-commerce platform Taobao. These products cover fields such as information technology, artificial intelligence, aerospace, new energy and quantum technology.

For example, consumers can directly purchase the country's independently developed AS700 civil manned airship and enjoy discounts. The airship can be used for sightseeing, emergency rescue and geophysical exploration of the skies, among other things.

The Double Eleven festival was just a 24-hour event on Nov 11 when it was unveiled by Alibaba in 2009, but has stretched into a weekslong shopping spree lasting from mid-October to mid-November this year. Online retailers initiated the promotional event one week earlier this year than previously.

"Consumption has become the main driving force boosting China's economic growth, and the Singles Day shopping carnival is pivotal to unleashing consumers' purchasing potential, bolstering domestic demand and promoting consumption recovery," said Wang Yun, a researcher at the Chinese Academy of Macroeconomic Research.

More stimulus policies are needed to stabilize and expand employment, improve household incomes, and boost people's ability and willingness to spend, so as to further perk up consumption, Wang added.

China's retail sales, a significant indicator of consumption strength, rose 3.3 percent year-on-year in the first three quarters of this year, said the National Bureau of Statistics. Online sales remained a bright spot, rising 8.6 percent year-on-year during the January-September period.

Based on a survey by global consulting firm AlixPartners in early October, consumers still view Singles Day as the most important shopping festival. Most consumers are likely to maintain their spending levels from the previous year, with 25 percent of interviewed shoppers saying that there would be an increase in their overall spending, the consultancy said.

Most of the increased spending based on the survey would be in apparel, daily necessities and cosmetics. Consumers are likely to remain sensible in their spending given the current economic backdrop, it added.

Online retailers have made promotional methods simpler this time, with a key focus on improving user experience and seeking high-quality and long-term growth, as Chinese consumers are more prudent and rational about potential purchases, said Jason Yu, managing director and vice-executive president of CTR Media Convergence Institute.

Yu said retailers hope to roll out new products to attract consumers and build brand image during the shopping spree.

High-quality and intelligent commodities are crucial for stimulating the purchasing appetite of consumers and unleashing new consumption potential, he said.

"A series of pro-consumption policies, such as the consumer goods trade-in program, have played a significant role in bolstering the sales of consumer electronic products and household appliances on major online marketplaces," Yu added.

Meanwhile, Taobao and Tmall have officially integrated JD's logistics during this year's shopping carnival as sellers on these platforms can choose JD Logistics as the delivery method. JD has accepted the mobile payment option from Alipay, which is operated by financial technology company Ant Group.

Industry insiders said these moves signify a key step in breaking down barriers between the two leading internet companies, enhancing interconnectivity of different platforms, and elevating the online shopping experience of users.

Mo Daiqing, a senior analyst at the Internet Economy Institute, a domestic consultancy, said major e-commerce platforms have ramped up efforts to offer steep discounts and shopping subsidies as well as simplify promotion methods during the prolonged shopping carnival to rev up sales.

"The policy measures to encourage trade-ins of consumer goods have not only stimulated consumers' desire to purchase, but also bolstered the sales and upgrades of household appliances, and propelled the popularity of green and energy-saving products," Mo said.

She noted that Chinese consumers have become more value-conscious and are paying more attention to the quality and cost-effectiveness of commodities. Mo also emphasized that online retailers should launch new products and upgrade supply chains to attract a new breed of young shoppers.

It is noteworthy that generative artificial intelligence technology has witnessed a ramp-up in China's retail industry during this year's 11-11 promotion.

According to a report from consultancy Bain & Company, Chinese retail players are investing in generative AI to boost sales and Singles Day could be the perfect opportunity.

The report said 52 percent of the surveyed merchants have used at least one generative AI-enabled tool. More than half of them have used generative AI-powered customer service chatbot tools, while about one in three have used AI to generate content. The survey interviewed over 500 merchants trading on China's major e-commerce platforms.

It stated that the era of high double-digit increases in the GMV during the Singles Day shopping spree has come to an end, forcing retailers to focus more on sustainable growth, profitability and customer loyalty, rather than a win-at-all-costs obsession with the top line amid current economic headwinds.

Kelly Liu, partner at Bain & Company's Greater China retail and performance improvement practices, said AI's increasing prominence across Chinese retail sector offers a timely boost to a maturing industry that is facing challenges such as slower retail sales growth.

Generative AI gives Chinese retailers access to a powerful tool for increasing sales and lowering cost, Liu said.

"It is vital that Chinese retailers deepen their customer engagement. AI tools can energize customer retention efforts, enabling e-commerce players to hyper-personalize their engagement with consumers and create bespoke shopping experiences for them," said James Yang, head of Bain & Company's Greater China retail practice.

Chinese retailers need to transition faster from AI experimentation to deployment at scale. The retailers that master generative AI in three key areas — deepening customer engagement, turbo-charging productivity and cost savings, and finding new growth beyond trade — could build a lasting strategic advantage, according to the report.